ELECTION INFORMATIONWhen will W-E Schools Issue 1 be on the ballot?

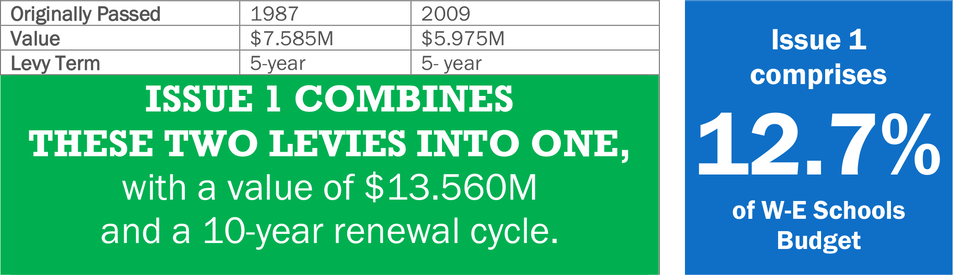

Willoughby-Eastlake schools are on the ballot on May 2nd without a tax increase. Early and Absentee Voting begins on April 4th. What is Issue 1? Willoughby-Eastlake voters are being asked to pass Issue 1 – which combines two current five-year renewal levies into one 10-year renewal levy. This money is a permanent part of the W-E budget and combining them into one will save tens of thousands of taxpayer dollars through reduced ballot and legal fees, which must be paid each time the district appears on the ballot. Information on those original levies is as follows: |

TAXPAYER INFORMATIONHow much will Issue 1 cost taxpayers?

|

DISTRICT FINANCIALSWhat will this levy fund?

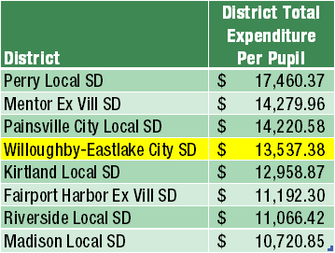

Passage of this renewal keeps current programming in place. Without this renewal the district will lose more than $13 Million per year and would need to make significant cuts to balance the District’s budget and avoid a state takeover. How much does it cost to run the district?

Aren’t W-E Schools always on the ballot asking for more money?

What about the new school buildings in our District? Levies are for learning. Building construction costs are paid for by bonds. Willoughby-Eastlake passed a bond issue in 2015 that paid for the North, South, and Longfellow buildings. No money from bond issues can legally be used for district operations.

|

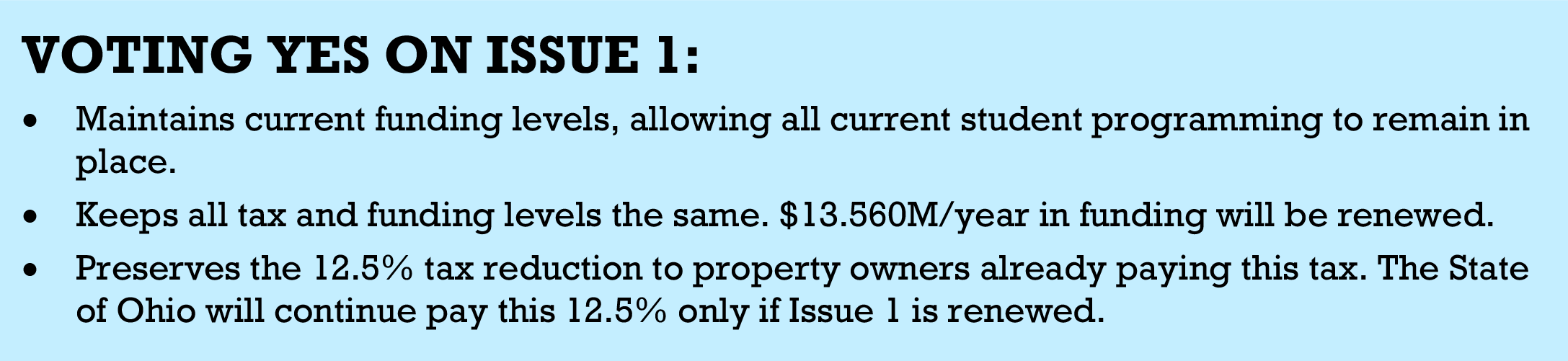

ISSUE 1 SCHOOL IMPACTSWhat is at stake?

|

ISSUE 1 COMMUNITY IMPACT

|